How Private Wealth Management copyright can Save You Time, Stress, and Money.

Wiki Article

Investment Representative - An Overview

Table of Contents8 Simple Techniques For Investment RepresentativeGetting The Lighthouse Wealth Management To WorkLittle Known Questions About Financial Advisor Victoria Bc.The Facts About Retirement Planning copyright RevealedWhat Does Independent Investment Advisor copyright Do?6 Simple Techniques For Private Wealth Management copyright

Heath normally an advice-only planner, therefore he does not manage their customers’ cash directly, nor really does he sell them specific financial products. Heath says the appeal of this method to him usually the guy does not feel bound to supply a particular product to resolve a client’s cash issues. If an advisor is just prepared to sell an insurance-based means to fix difficulty, they might wind up steering some body down an unproductive course for the title of striking revenue quotas, he states.“Most financial services folks in copyright, because they’re compensated using the items they feature and sell, they are able to have reasons to advise one plan of action over another,” he states.“I’ve picked this program of motion because i will have a look my customers in their eyes rather than feel just like I’m using all of them at all or trying to make a sales pitch.” Tale continues below ad FCAC notes how you shell out the expert varies according to this service membership they give.

Not known Details About Investment Consultant

Heath and his ilk tend to be settled on a fee-only design, consequently they’re compensated like a legal professional can be on a session-by-session foundation or a per hour assessment price (investment representative). Depending on the variety of solutions plus the knowledge or common clients of the consultant or planner, hourly charges can vary for the 100s or thousands, Heath statesThis could be up to $250,000 and above, he states, which boxes around most Canadian families out of this level of solution. Story continues below advertising for anyone incapable of spend fees for advice-based techniques, as well as for those not willing to give up a percentage of the financial investment comes back or without adequate money to get started with an advisor, you can find less expensive and also complimentary options to consider.

The smart Trick of Retirement Planning copyright That Nobody is Talking About

Story continues below advertising discovering the right economic planner is a little like dating, Heath says: You want to discover someone who’s reliable, provides a character fit and is ideal individual when it comes down to stage of life you are really in (https://pastebin.com/u/lighthousewm). Some like their unique analysts become more mature with a bit more experience, he says, while others choose some one more youthful who is going to ideally stay with them from early decades through retirement

The smart Trick of Ia Wealth Management That Nobody is Discussing

One of the largest errors somebody make in choosing a consultant is certainly not asking adequate concerns, Heath says. He’s shocked as he hears from customers that they’re stressed about asking concerns and potentially appearing dumb a trend the guy finds is simply as common with developed professionals and the elderly.“I’m amazed, given that it’s their cash and they’re spending plenty fees to the individuals,” according to him.“You deserve to own the questions you have answered while are entitled to to own an unbarred and sincere connection.” 6:11 Financial Planning for all Heath’s last guidance applies whether you’re looking for outdoors monetary support or you’re heading it by yourself: keep yourself well-informed.Listed here are four points to consider and ask your self whenever finding out whether you ought to touch the expertise of a financial consultant. Your own net value just isn't your earnings, but rather a quantity that can assist you understand what cash you earn, simply how much it will save you, and the place you spend money, too.

More About Investment Consultant

Your infant is on ways. Your splitting up is actually pending. You’re approaching retirement. These and other significant life occasions may encourage the need to see with an economic expert about your opportunities, your financial objectives, as well as other financial issues. Let’s say your own mother kept you a tidy sum of cash in her might.

You have sketched out your very own financial plan, but I have a difficult time staying with it. A monetary specialist can offer the responsibility you need to put your financial plan on track. In addition they may recommend how to modify your own economic program - https://www.figma.com/file/s8Vaj67obmkUicwsR3oif6/Untitled?type=design&node-id=0%3A1&mode=design&t=YuDMincaiJl6SSo0-1 so that you can maximize the possibility outcomes

The Ultimate Guide To Investment Representative

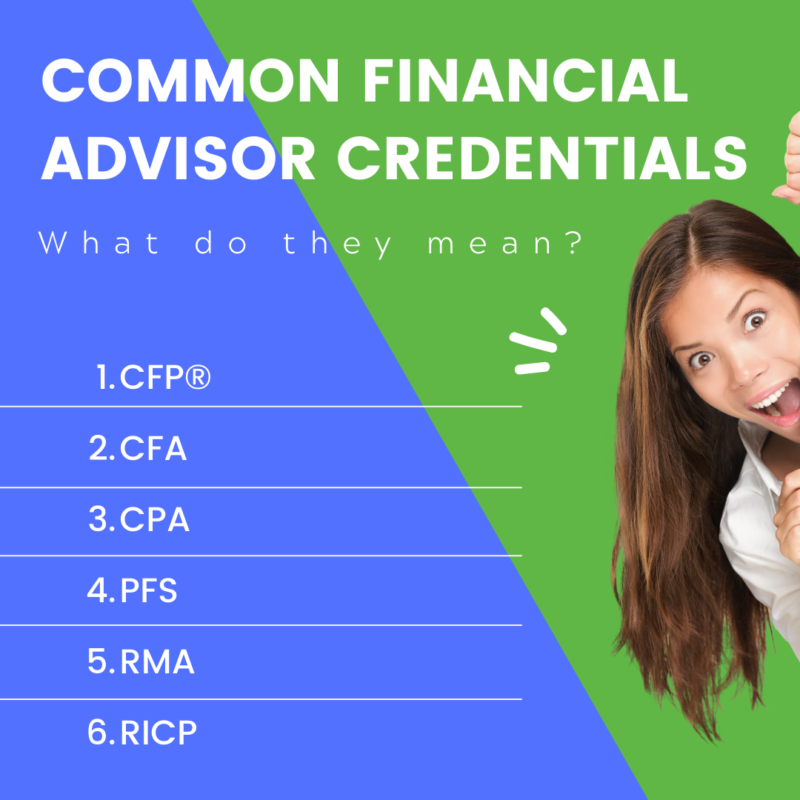

Anyone can state they’re a financial expert, but a consultant with expert designations is actually preferably the one you should hire. In 2021, around 330,300 Us citizens worked as personal monetary analysts, according to the U.S. Bureau of Labor Statistics (BLS). The majority of economic advisors are freelance, the bureau claims - ia wealth management. Typically, there are five types of monetary analysts

Agents typically make earnings on deals they make. Brokers are managed by the U.S. Securities and Exchange Commission (SEC), the Investment field Regulatory Authority (FINRA) and state securities regulators. A registered financial investment specialist, either one or a strong, is similar to a registered consultant. Both buy and sell assets for their customers.

Report this wiki page